- CONTACT US

- About G&E

- Practice Areas

- U.S. Securities Litigation

- International Securities Litigation

- Corporate Governance Litigation

- M&A Litigation

- Alternative Investment Litigation

- Antitrust Litigation

- International Arbitration

- Bankruptcy & Distressed Litigation

- Public Entity Litigation

- Environmental/Toxic Tort Litigation

- Complex & Mass Tort Litigation

- Catastrophic Injury Litigation

- Birth Injury Litigation

- Child Victims Act & Clergy Litigation

- Civil Rights, Sexual Assault/Harassment & Discrimination Litigation

- Consumer Litigation

- Whistleblower/False Claims Litigation

- Cases

- Attorneys

- Client Services

- News & Events

Legal Considerations

in Responsible Investment

The Grant & Eisenhofer ESG Institute

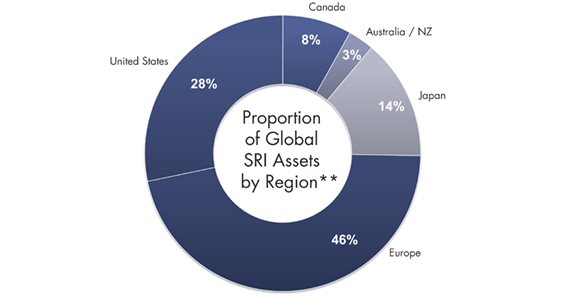

Global investor interest in sustainable and responsible investment continues to accelerate more and more rapidly. Responsible investment strategies take into consideration environmental, social and governance (ESG) factors in portfolio selection criteria and management, with the belief that better corporate ESG profiles result in fewer disasters and corporate scandals, and better long-term returns. Additionally, investors increasingly realize the importance of furthering the greater good of society, which is contributing to a shift from a focus on investors’ role as shareholders to their role as stakeholders. Investment policies that integrate ESG criteria tend to express investor values specific to weapons, carbon emissions, fossil fuel reserves, labor conditions, human rights, corporate governance, executive compensation, #metoo, climate and other social and environmental issues. Corporate engagement and shareholder activism are additional approaches investors are increasingly using to influence corporate behavior in furtherance of ESG principles. Regulatory developments around the world are reinforcing this trend, including the establishment of the SEC’s Climate and ESG Task Force and the EU’s Corporate Sustainability Due Diligence and Corporate Sustainability Reporting Directives, and evolving EU rules to protect consumers from greenwashing. As an example of investor enthusiasm for ESG funds, London-based ETFGI reported in December 2023 that globally listed assets invested in ESG ETFs increased to US$481 billion from the US$393 billion reported at the end of 2022.* $30.3 trillion is currently invested globally in sustainable AUM, with the non-US markets showing an increase of 20% since 2020.**

With a quarter century of actively protecting and promoting the rights of institutional investors and public entities, Grant & Eisenhofer has built a legacy in corporate governance with an unwavering commitment to responsible investment. The Firm has cemented this history with an initiative expressly designed to address the increasing dialogue on ESG within the institutional investor community – the Grant & Eisenhofer ESG Institute. The ESG Institute is a non-profit organization formed in 2017 with the mission of harnessing its members’ legal skills to work with investors to further a wide array of ESG goals. To this end, the Institute pursues select matters exclusively to promote legal issues related to ESG considerations, and offers thought leadership in the discipline. The Institute also aims to address, on an ongoing basis, the legal issues that decision-makers and stakeholders in the investment community grapple with in implementing responsible investment criteria.

Legal issues the ESG Institute focuses on include:

- Sustainability and Fiduciary Duty

- Climate Change and Securities Law

- Corporate Legal Responsibility for Activity in Developing Countries

- Legal Challenges to Limit Compensation

The ESG Institute is led by G&E attorneys and is guided by an Advisory Board comprised of a diverse range of investors with global experience spanning asset managers, public pension funds and nonprofits, all of whom have a demonstrated track record of commitment to ESG causes.

View examples of G&E's ESG-Related Cases

* Source: ETFGI.com Press Release – December 22, 2023

** Source: Global Sustainable Investment Review 2022 © Global Sustainable Investment Alliance 2023

Featured Article

SEC Adopts Final Version

of Climate Change

Disclosure Rules

Other ESG Related Articles

False Claims by Former CEO of EV and Energy Co. Nikola Point to Greenwashing

White House Releases Report Addressing the Intersection Between Cryptocurrency and Climate Change

ESG-related Claims Expected to Spur Additional Litigation as OS Investors Gain Traction in Securities Fraud Cases

ICGN-GISD Partner with ESG Institute to Standardize Legal ESG Draft Clauses for Updated Model Mandate

Principles for Responsible Investment (PRI) Partners with G&E to Provide Standardized Legal ESG Clauses

SEC Votes 3-1 on Climate Change Disclosure Rules

SEC Proposes Long-Awaited

Climate Change Disclosure Rules

Department of Labor Proposed Rule re ESG Investments

U.S. Senate Re-introduces the Uyghur Forced Labor Prevention Act

ESG Institute Submits Amicus Brief Supporting Corporate Liability for Child Slavery in Supply Chain

U.S. Bans Importation of Malaysian Palm Oil Products Following Petition Filed by the G&E ESG Institute

G&E Petitions to Block Palm Oil Imports Using Child and Forced Labor

ESG Initiatives Adopted by Exchanges

Hedge Funds Making Progress, But Slow to Adopt ESG

Uzbek Working to End Forced Labor in Cotton Fields

EU Agrees on New Requirements Regarding Sustainable Investments and Sustainability Risk Disclosures

Investment Professionals Increasingly Focused on ESG Factors

Aon Survey Shows 68% of Global Investors Consider Responsible Investing Important

Large Investors Ask SEC to Issue Rules on ESG Disclosure Standards

Ninth Circuit Holds No Duty to Disclose Unfair Labor Practices Under California Consumer Protection Law

D.O.L. Qualifies ERISA Fiduciaries’ Obligations Regarding ESG Considerations

Copyright © Grant & Eisenhofer P.A. All Rights Reserved.